-40%

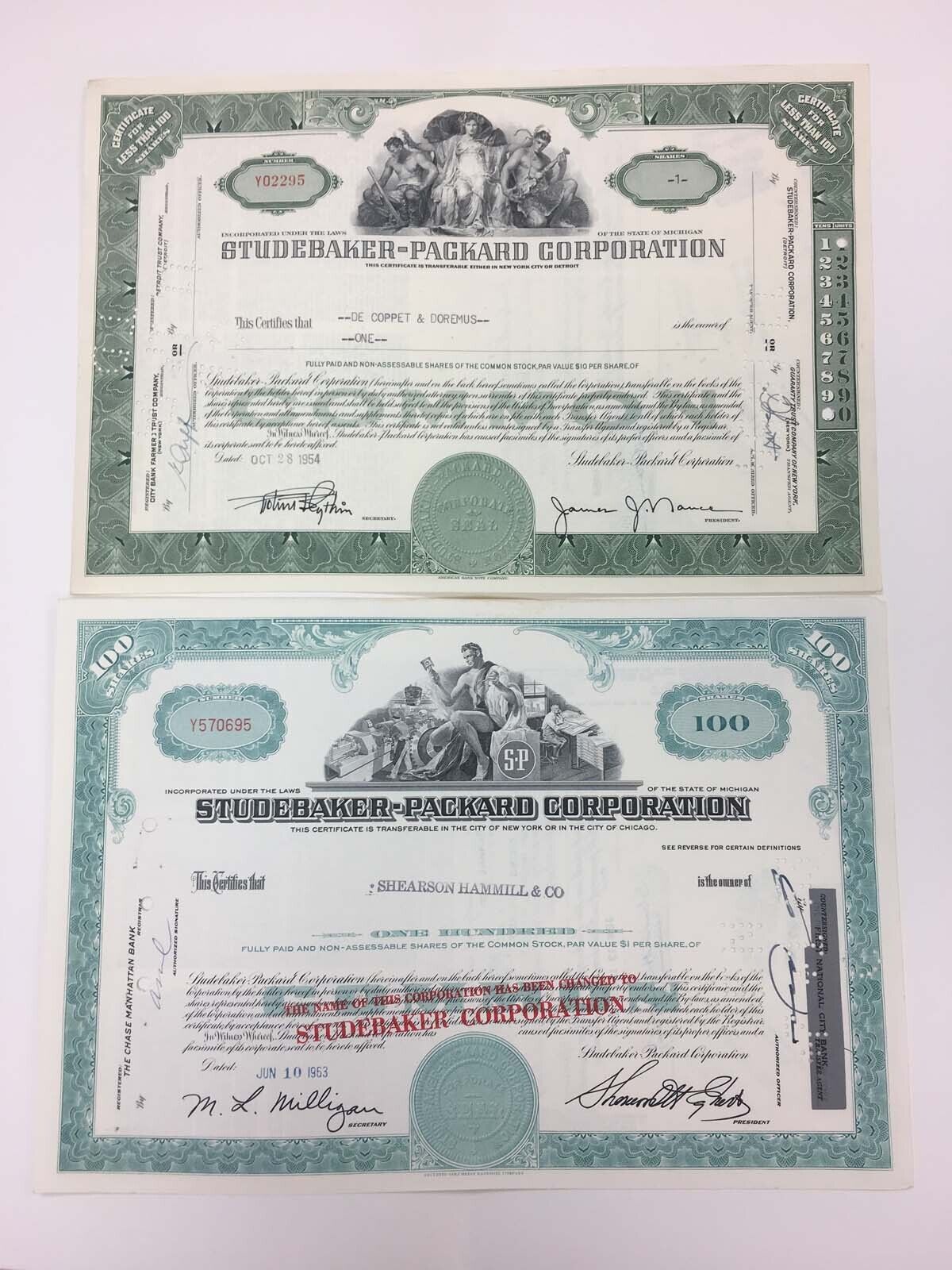

Studebaker-Worthington, Inc. Stock Certificate

$ 2.09

- Description

- Size Guide

Description

Studebaker-Worthington, Inc. Stock CertificateThis piece is a ghostsofwallstreet.com clearance item and is available exclusively in our Ebay outlet store!

Studebaker was once a strong automobile manufacturer, but sales had been steadily declining. In December 1963 Randolph H. Guthrie, chairman of Studebaker, announced that the company was closing down its automobile factory in South Bend Indiana, where it had made cars for 50 years, but would continue to make cars in Hamilton, Ontario. In 1965 auto sales were slightly less than million. On 4 March 1966 Studebaker announced termination of its car production. So far that year only 2,045 cars had been produced. Management said the decision was due to "heavy and irreversible losses" in the automobile division.

Business results for 1966 had total sales of 2 million, excluding automobile sales. Automobile sales for 1965 had been slightly less than million. Net income for 1966 was .4 million, much more than the previous year. The company was now profitable, and also had tax loss carry-forwards that made it an attractive target for a takeover. Studebaker further improved its position by selling off some unprofitable businesses. The most profitable of the divisions that remained were Clarke Floor Machines, Gravely Tractor, Schaefer Chemical Compounds (later to become STP Corporation) and Onan.

The 1967 merger that created the company was arranged by the entrepreneur Derald Ruttenberg, who took the risk of buying Studebaker despite the liabilities that came with it, including dealer warranties and union agreements. He saw that Onan generators and STP engine additives were healthy businesses. The large tax loss was also valuable. Worthington was expected to continue to earn steady profits, but could use the tax loss to avoid paying taxes.

The stockholders of Studebaker and Worthington approved the merger despite rumors that the Federal Trade Commission considered the merger would be "substantially anti-competitive". The combined 1966 gross revenues of the two companies had been 2 million, with net income of .5 million. Studebaker was acquired by Wagner Electric, which in turn was merged with Worthington Corporation to create Studebaker-Worthington. The merger was completed in November 1967, creating a company with 0 million of assets. The combined company included the profitable divisions from Studebaker, brake and electrical automobile component manufacturing from Wagner Electric, and diverse operations from Worthington that included manufacture of construction equipment, valves and power generation plant.

Frequently Asked Questions:

Is the certificate in this listing, the exact piece I will receive?

Yes.

Is this document authentic or a reproduction?

All pieces we offer are originals - we do not sell reproductions. If you ever find one of our pieces not to be authentic, it may be returned at any time.

Can this certificate be cashed in?

All of our certificates are sold only as collectible pieces, as they are either canceled or obsolete. Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied.

Do you combine shipping?

We offer flat rate shipping - whether you order 1 certificate or 100 - you pay only the published flat rate.

To take advantage of our flat rate shipping offer,

you must add all of the pieces you would like to your eBay cart

and perform a single checkout. If you use "Buy It Now" for each individual certificate, you will be charged a shipping charge each time - this is an unfortunate limitation of the eBay system.

Is all of your inventory on eBay?

Absolutely not! We have 1,000s of certificates on our website.